Consumer sentiment is a critical economic indicator that measures the overall attitude of consumers toward the economy and their financial situation. It provides valuable insights into consumer confidence, spending habits, and future economic expectations. Understanding how consumer sentiment shapes economic forecasts is vital for businesses, economists, and policymakers.

Understanding Consumer Sentiment

Definition

Consumer sentiment refers to how optimistic or pessimistic consumers are about the economy's current state and their financial future. It encompasses perceptions about job security, income levels, inflation, and overall economic health. High consumer sentiment typically indicates confidence in the economy, while low sentiment suggests uncertainty and concern.

Importance of Consumer Sentiment

Indicator of Economic Activity: Consumer sentiment serves as a leading indicator of economic activity. When consumers feel confident, they are more likely to spend money, stimulating economic growth.

Investment Decisions: Businesses often rely on consumer sentiment data to guide investment decisions, including inventory purchases, hiring, and expansion plans.

Policy Formation: Policymakers use consumer sentiment indicators to assess public perception of the economy, which influences decisions on fiscal and monetary policies.

Market Predictions: Financial markets closely monitor consumer sentiment, as changes in confidence can lead to fluctuations in stock prices and investment strategies.

Factors Influencing Consumer Sentiment

Consumer sentiment is influenced by various factors, including:

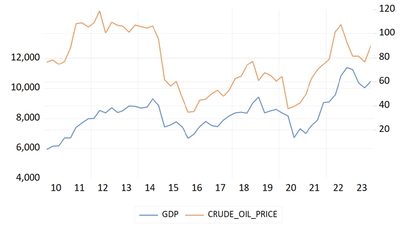

Economic Indicators: Key economic indicators such as unemployment rates, inflation rates, and GDP growth can impact consumer attitudes.

Political Stability: Political events and government policies can significantly affect consumer confidence. Uncertainty surrounding elections or policy changes can lead to lower sentiment.

Media Coverage: News reports and media narratives about the economy can shape public perception and influence sentiment levels. Positive news can boost confidence, while negative reports can dampen it.

Personal Financial Situation: Consumers’ own financial circumstances, including employment status, income levels, and debt loads, play a crucial role in shaping their sentiment.

Measuring Consumer Sentiment

Surveys and Indices

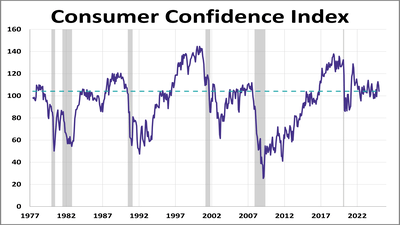

Consumer sentiment is typically measured through surveys conducted by various organizations. Two of the most recognized indices measuring consumer sentiment are:

The Conference Board Consumer Confidence Index: This index surveys a representative sample of households to gauge their perceptions of current and future economic conditions. It comprises two components: the Present Situation Index and the Expectations Index.

The University of Michigan Consumer Sentiment Index: This index offers a broader view of consumer sentiment and includes questions on personal finances, business conditions, and expectations for the economy.

Key Components of Consumer Sentiment Surveys

Consumer sentiment surveys often assess the following components:

Current Economic Conditions: Consumers are asked about their perceptions of the current economy, job market, and personal financial situation.

Future Expectations: Participants provide their expectations for the economy over the next six months, including anticipated changes in income, employment, and inflation.

Spending Plans: Surveys often include questions about consumers’ plans for significant purchases, such as homes, cars, and durable goods, which can indicate future economic activity.

The Impact of Consumer Sentiment on Economic Forecasts

1. Spending Behavior

Consumer sentiment has a direct impact on spending behavior. High confidence often leads to increased consumer spending, which is a significant driver of economic growth. Conversely, low consumer confidence can result in reduced spending, leading to slower economic growth or even recession.

Case Study: The 2008 Financial Crisis

During the 2008 financial crisis, consumer sentiment plummeted as job losses and declining home values created widespread uncertainty. This decline in sentiment resulted in reduced consumer spending, compounding the economic downturn.

2. Business Investment

Businesses rely on consumer sentiment data to forecast demand for their products and services. When sentiment is high, businesses are more likely to invest in expansion and hiring. Conversely, when sentiment is low, businesses may hold off on investments, affecting economic growth.

3. Economic Policy

Policymakers use consumer sentiment as a barometer for economic health. If sentiment indicates a lack of confidence in the economy, policymakers may implement measures such as fiscal stimulus or changes to interest rates to bolster consumer confidence and spending.

4. Financial Markets

Consumer sentiment is closely monitored by financial markets. Changes in sentiment can lead to fluctuations in stock prices. Positive sentiment may lead to increased investment in stocks, while negative sentiment can result in sell-offs and market volatility.

5. Inflation Expectations

Consumer sentiment also influences inflation expectations. When consumers feel optimistic about the economy, they anticipate higher prices and may be more willing to spend. This behavior can lead to actual inflationary pressures as demand increases.

Consumer Sentiment and Economic Predictions

Forecasting Techniques

Economists use various techniques to incorporate consumer sentiment into economic forecasts. These can include:

Statistical Models: Econometric models often include consumer sentiment as an explanatory variable to predict GDP growth, retail sales, and other economic indicators.

Leading Economic Indicators: Consumer sentiment is used alongside other leading economic indicators, such as manufacturing activity and stock market performance, to create a comprehensive economic outlook.

Qualitative Analysis: Analysts often use qualitative information from sentiment surveys, such as consumer comments and concerns, to gauge potential shifts in economic trends.

Limitations of Consumer Sentiment in Forecasting

While consumer sentiment is a valuable indicator, it has limitations:

Subjectivity: Consumer sentiment relies on subjective perceptions, which can be influenced by temporary factors or media narratives.

Delayed Reaction: Changes in consumer sentiment may not immediately translate into spending behavior. There can be a lag between sentiment shifts and actual economic activity.

External Shocks: Sudden economic events, such as natural disasters or geopolitical crises, can overshadow consumer sentiment, leading to unexpected economic outcomes.

Broader Implications of Consumer Sentiment on the Economy

1. Economic Resilience

Consumer sentiment plays a crucial role in an economy's resilience. When consumers remain confident even in challenging times, they can sustain spending levels, helping to stabilize economic growth.

2. Social Impact

The social impact of consumer sentiment is significant. High consumer confidence can lead to greater overall satisfaction and well-being among individuals, while low confidence can contribute to anxiety and uncertainty in society.

3. International Relations

Consumer sentiment affects international trade dynamics as well. A country with high consumer confidence may import more goods, impacting trade balances and relationships with trading partners.

4. Long-Term Economic Trends

Shifts in consumer sentiment can signal broader societal changes, including shifts in demographics, technology use, and cultural attitudes. Understanding these trends can inform businesses and policymakers as they plan for the future.

Strategies to Improve Consumer Sentiment

1. Economic Education

Improving economic literacy can help consumers make informed decisions about their finances and the economy, fostering greater confidence in the market.

2. Transparent Communication

Governments and businesses should prioritize transparent communication regarding economic policies, employment opportunities, and inflation expectations to build trust among consumers.

3. Support for Employment

Policies that support job creation and workforce development can contribute to improved consumer sentiment, as job security is a critical factor in consumer confidence.

4. Promoting Financial Stability

Encouraging savings and responsible financial practices can help consumers feel more secure, bolstering their confidence in the economy.

Conclusion

Consumer sentiment is a vital economic indicator that shapes economic forecasts and influences overall economic health. Understanding how consumer attitudes impact spending, investment, and policy decision-making is essential for navigating the complexities of the global economy.

As we move forward, it becomes increasingly important for businesses, economists, and policymakers to monitor consumer sentiment and respond proactively to shifts in consumer confidence. By fostering a positive environment for consumers, stakeholders can help ensure sustained economic growth and stability in an ever-evolving economic landscape.